For the owner, this new service from the tax authorities allows you to fill in various fields relating to his property. You can categorise your property (building, house, flat, land, etc.), specify its surface area and even the number of rooms. The tool provides information to facilitate their declarations. Owning several properties can be a real headache.

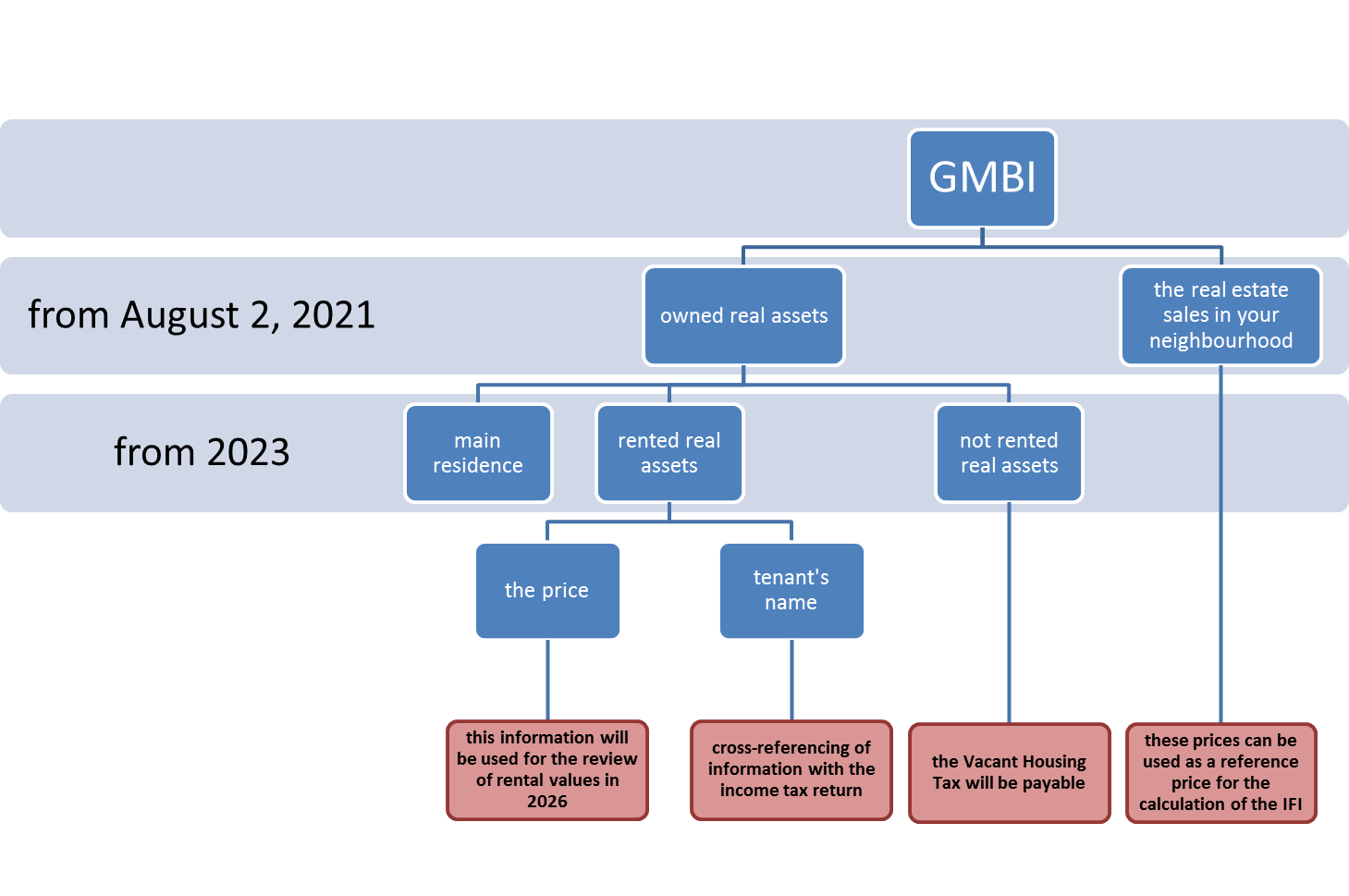

Finding a single platform to declare the rental of a property, but also the identity of the tenants, can be useful, even if it will be necessary to make updates in the event of changes (resale, change of tenants, etc.). But the GMBI function found on impôts.gouv.fr is multi-faceted and is also useful for the tax authorities.

With this tool, the verification of data will be simplified, which will allow the calculation of the property tax that must be requested for each dwelling and this in dematerialized mode. Another target of the government is the revision of cadastral rental values. For information, this value is still based on what was practiced in the 1970s. The government intends to change this, but the reform will only come into force in 2026.

Tax on vacant real assets (Taxe sur les logements vacants TLV).

However, from 2023 onwards, landlords will be able to use the tax site to declare the rents they charge to their various tenants. Does this correspond to the real value of the property, depending on its location? This will be the key to being able to increase the rent or not. The disappearance of the taxe d'habitation for primary residences will not be effective until 2023. After that date, however, it will continue to apply to secondary residences but also to vacant dwellings.

This service will make it possible to identify them because the owner must normally pay a tax; the TLV (tax on vacant dwellings); the amount of which varies according to the length of the period of vacancy (12.5% the first year in which the house or flat is taxable, then the amount of the tax increases to 25%). Knowing that the amount of the tax is calculated on the basis of the rental value and that the latter is going to be revised, everything makes sense. The owner concerned will probably have to find a way to avoid paying this tax, by finding tenants or by selling their property...

Sources:

https://www.bfmtv.com/economie/patrimoine/impots-fiscalite/gerer-mes-biens-immobiliers-la-derniere-nouveaute-du-site-impots-gouv-fr_AV-202108040320.html

https://www.netpublic.fr/blog/gmbi-gerer-mes-biens-immobiliers-nouveau-service-du-site-des-impots/